As of February 2026, Oregon maintains one of the most expansive state-funded safety nets for undocumented residents in the United States. While federal law (PRWORA 1996) restricts undocumented individuals from most federal benefits, Oregon uses state statutes, appropriations, and constitutional provisions to fill those gaps.

1. Direct Cash Assistance & Tax Refunds

Undocumented residents who file Oregon taxes using an ITIN (Individual Taxpayer Identification Number) are considered “taxpayers” under Oregon law and are eligible for the following refundable payments.

- Oregon Kicker Refund (2026 Cycle):

- Benefit: A refund of surplus state revenue, issued as a credit on the 2025 tax return filed in 2026.

- Amount: 9.863% of your 2024 tax liability.

- Law: Oregon Constitution, Art. IX, § 14; ORS 291.349.

- Oregon Kids Credit:

- Benefit: Fully refundable credit of $1,050 per child (ages 0–5).

- Limits: Full credit for MAGI under $26,550; phase-out up to $31,550.

- Law: ORS 315.264 (HB 3235).

- Oregon Earned Income Credit (EIC):

- Benefit: State credit matching 9%–12% of the federal EITC. Unlike federal rules, Oregon allows ITIN filers to claim this cash refund.

- Law: ORS 315.266 (SB 1502).

- Working Family Household & Dependent Care (WFHDC):

- Benefit: Refundable childcare credit for working parents (ITIN eligible).

- Law: ORS 315.262.

2. Health Care (Medical, Dental, Mental Health)

- Healthier Oregon / Cover All People:

- Benefit: Full-scope Oregon Health Plan (OHP) for all low-income residents regardless of status.

- Note (2026 Alert): The Oregon Health Authority (OHA) issued a 2026 notice that state-funded OHP remains safe, despite proposed federal rule changes regarding data sharing.

- Law: ORS 414.231 (HB 3352).

- Cover All Kids: Full OHP for all residents under 19. (ORS 414.231 / SB 558).

- Emergency Care (CAWEM): Coverage for life-threatening emergencies, including dialysis and cancer. (ORS 414.025).

3. Food & Nutrition

- Universal School Meals (SB 1581):

- Benefit: Free breakfast and lunch for all students regardless of family income or status. Effective July 1, 2026, statewide.

- Anti-Hunger Bridge Funding:

- Benefit: State funds used to provide food assistance to non-citizens who lost SNAP eligibility due to federal 2025/2026 policy shifts.

- Status: Funded via 2026 Legislative Appropriations.

- WIC: Supplemental nutrition for pregnant people and children under 5 (Immigration-neutral).

4. Labor & Emergency Wage Replacement

- Oregon Worker Relief (OWR):

- Benefit: Cash for workers excluded from unemployment who lose wages due to Climate Disasters (Level 3 wildfire evacuations, heat over 100°F, or hazardous smoke).

- Authority: Community-led; funded via OIRA (ORS 411.139).

- Paid Leave Oregon:

- Benefit: Paid family/medical leave. Eligibility is based on Oregon earnings ($1,000 minimum), not citizenship.

- Law: ORS Chapter 657B.

5. Education & Financial Aid

- Tuition Equity: In-state tuition at public universities and community colleges. (ORS 350.053 / HB 2787).

- State Financial Aid (ORSAA): Access to Oregon Opportunity Grant and Oregon Promise (free community college) via the ORSAA application. (ORS 348.285 / SB 932).

6. Legal & Civil Protections

- Universal Representation Fund:

- Benefit: Free immigration attorneys for low-income residents in deportation proceedings.

- 2026 Update: HB 4117 (2026) expands this fund to combat increased federal enforcement activity.

- Law: ORS 9.572.

- Sanctuary Promise Act: Prohibits state/local police from assisting ICE or investigating immigration status. (ORS 181A.820 – 181A.825 / HB 3265).

- Driver’s Licenses for All: Standard licenses/IDs available without proof of legal presence. (ORS 807.021 / HB 2015).

Oregon’s Expansive Benefits for Undocumented Residents – Taxpayer Perspective (2026)

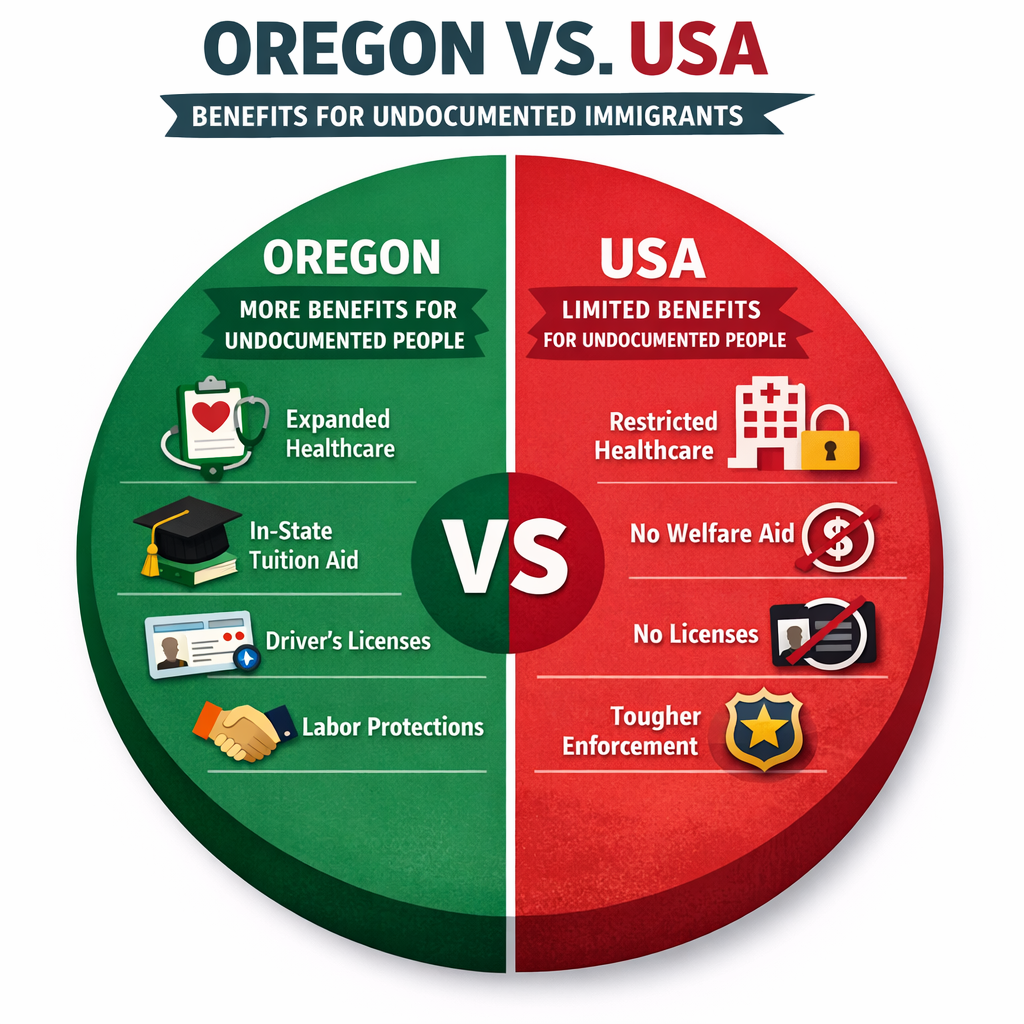

Oregon ranks among the top states providing state-funded benefits to undocumented residents, using state law to bypass federal restrictions. Taxpayer dollars fund a wide array of programs that are largely inaccessible to legal residents only through federal support:

- Cash Payments & Tax Refunds: Undocumented residents filing with ITINs can claim refundable credits, including the Oregon Kicker, Oregon Kids Credit, and the state Earned Income Credit—programs intended to support working families.

- Healthcare: Full-scope Oregon Health Plan (OHP) coverage is available regardless of immigration status, covering medical, dental, and mental health services.

- Food & Nutrition: Free school meals and state-funded anti-hunger programs extend to undocumented residents, in addition to federal programs.

- Wage & Disaster Relief: State-funded emergency wage replacement and paid leave programs are available without citizenship verification.

- Education: In-state tuition and state financial aid (Oregon Opportunity Grant, Oregon Promise) are accessible to undocumented students.

- Legal & Civil Protections: Taxpayer-funded legal representation in immigration cases and driver’s licenses are granted without proof of lawful presence.

Bottom line: Oregon uses state resources to provide a comprehensive safety net for undocumented residents programs funded by legal taxpayers and extending benefits typically unavailable under federal law.